When interest rates are hiked, demand to invest in the country increases, which lifts demand for the currency. Interest rates influence a currency’s value.

As per this baseline, we see USD/INR in a consolidative phase in 2023, slow in returning to the lower half of its 80-83 price channel, with the central bank likely to be focused on replenishing its reserves war chest.” Interest rates in India “Our outlook for currencies to recover in 2023 hinges on Fed hikes pausing and the world economy averting a hard landing. Radhika Rao, Executive Director & Senior Economist at DBS Bank:

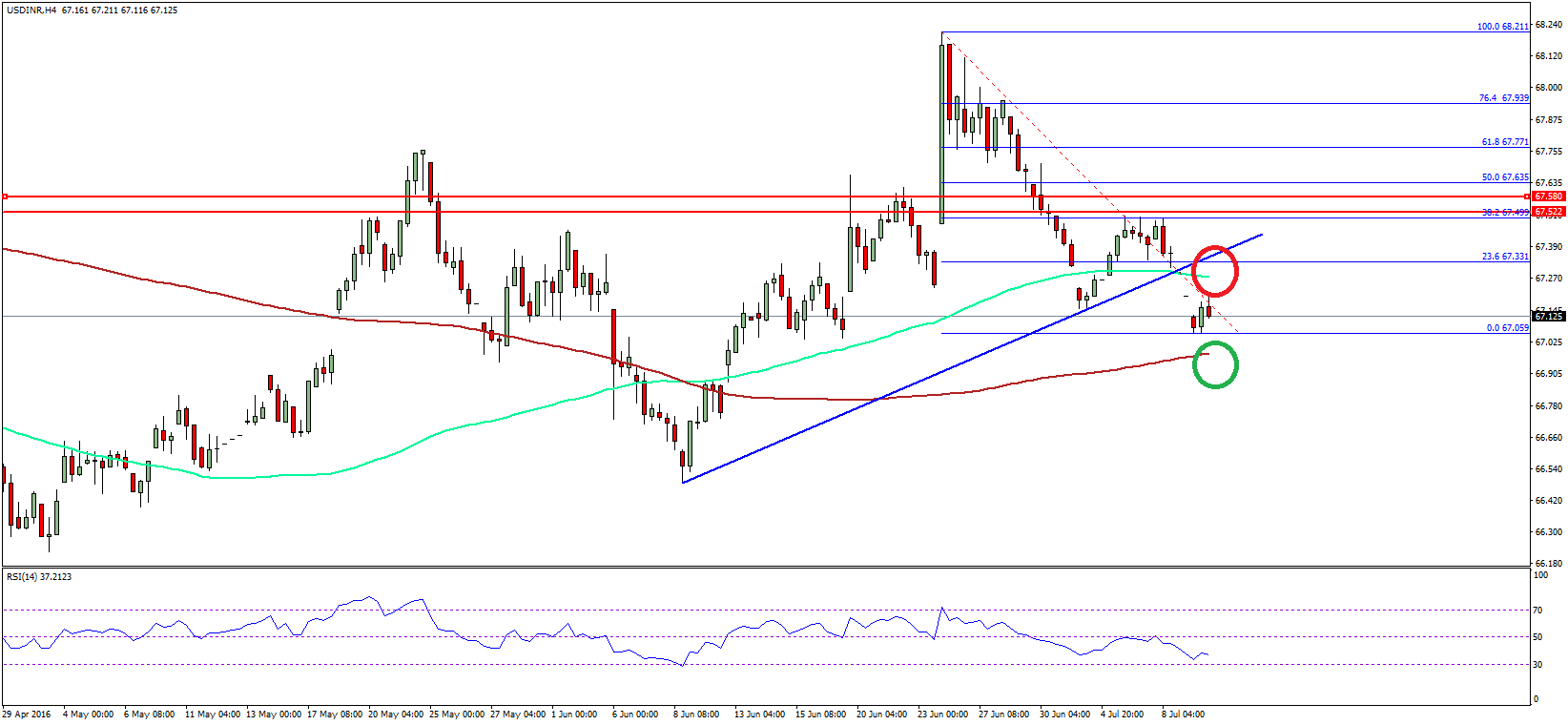

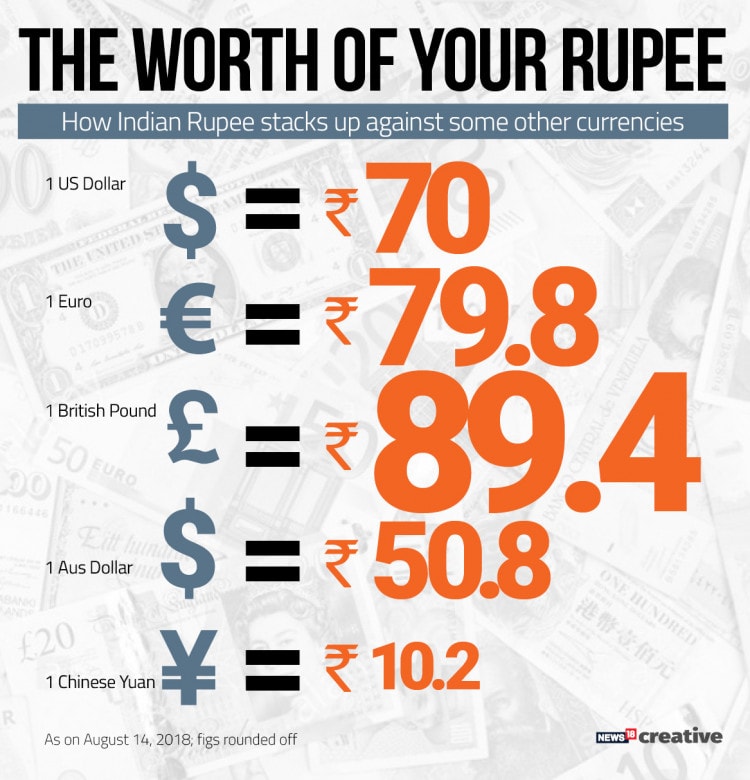

But the USD, current deficit in India, forex reserves and domestic macro-economic developments will determine how the rupee perfroms in 2023. There is no single factor that drives the value of the Indian rupee, but several factors combine to influence its movement. When necessary, it intervenes in buying or selling foreign currency to support the rupee’s price stability. Therefore, it monitors movements in the currency and financial markets closely. The RBI’s exchange rate policy ensures orderly conditions in the foreign exchange market. The currency is now a free-floated exchange rate influenced by supply and demand. Due to the decline in the share of trade with Britain and the increased diversification of India’s international transactions, the rupee was delinked from the pound in September 1975. The rupee was pegged to the pound due to its historic links to Britain. In 1947 it replaced the currencies of the previously autonomous states, becoming the national currency. The Indian rupee is the official currency of India and is issued by the Reserve Bank of India (RBI). Krishnamurthy Subramanian, former chief economic advisor (CEA) to the Indian government, tweeted in late September: That said, the rupee’s 8.5% decline against the greenback since January matched up with the weakness experienced by most dollar-paired currencies. The rupee continued to slide in the face of tightening monetary policy in the US, coming in at a dramatic all-time low (82.77) against the dollar on 20 October. The USD/INR price then eased lower to 78.13 before another ascent to retest the all-time low once more in August. The USD/INR pair climbed higher across the year, with the rupee reaching its first all-time low of 80.20 on 14 July. The rupee started the year at 74.40 against the dollar and steadily weakened. The rupee declined over 11% in 2022, as it struggled against global developments. How did the Indian rupee performed in 2022? Here we look in more detail at what has been driving the rupee price and where it may go next. We have to remain unwavering in our commitment to bring down inflation." We need to see a decisive moderation in inflation. "The stickiness of core or underlying inflation is a matter of concern. Since May, the RBI’s rate-setting panel has raised the country’s repo rate by 1.9% to 6.50%. Some analysts expect the hike to be the final increase in the RBI's current tightening cycle, which has seen it raise rates by 250 bps since May 2022 – as major central banks across the world continue to battle high inflation. The central bank said that its policy stance remains focused on the withdrawal of accommodation, with four out of six members voting in favour of that position. In February, the Reserve Bank of India (RBI) hiked its key repo rate by a quarter percentage point, this was expected but still surprised markets by leaving the door open to more tightening, saying core inflation remained high. USD/INR was also got affected and started to surge once again. However, once the January CPI data was released, the dollar strength index rebounded strongly from these lows. This weakened the global currencies in terms of their dollar value. Indian Rupee started 2023 strong, in terms of the dollar as the DXY Index fell to a 6-month low of 100.8. The US dollar (USD) to INR exchange rate plunged to a low of 80.85 on 20th January, the lowest level since November 14. It dropped as the US dollar index continued plunging to the lowest level in months. The Indian rupee ( INR) price pulled back from its highest point in 2022 as the focus shifted to the potential Fed pivot this year. The rupee is the official currency of India – Photo: Sudarshan negi / Shutterstock

0 kommentar(er)

0 kommentar(er)